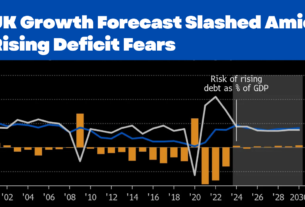

The Institute for Fiscal Studies (IFS) has warned that Chancellor Rachel Reeves is very close to needing to implement tax rises in the autumn if the UK’s economic outlook worsens. Despite recent announcements on spending and investment, the economic data remains fragile, with growth sluggish and inflationary pressures continuing to pose challenges.

Reeves’s budget strategy focuses heavily on long-term investments in infrastructure, health, and defense, funded through borrowing. However, the IFS cautions that the government’s fiscal rules allow little margin for error. Any further negative economic shocks could force the government to consider additional tax increases to maintain fiscal sustainability.

The Chancellor’s approach, described as “securonomics,” aims to balance economic security with growth, but critics argue that the risk of near-term tax hikes may dampen consumer confidence and investment. Labour leadership insists that the measures taken are necessary to stabilize the economy while protecting public services.

Meanwhile, public concern is rising over the prospect of higher taxes and council tax increases, which the government has proposed at a rate of 5% annually, the steepest rise in two decades. This, coupled with warnings from economic analysts, has put pressure on Reeves to carefully navigate the delicate balance between investment and fiscal prudence.

As the autumn fiscal review approaches, attention will focus on whether economic conditions improve enough to avoid tax rises or whether the Chancellor must act to secure the government’s finances. The situation underscores the ongoing challenges facing the UK government in managing economic recovery amid global uncertainties and domestic pressures.