The UK government’s finances came under fresh scrutiny in May as borrowing climbed to £17.7 billion, the second-highest total for that month on record. Only May 2020, during the peak of pandemic-related spending, saw a higher figure. This year’s borrowing total was £0.7 billion more than the same time last year, underscoring the challenges facing the new government as it attempts to balance public investment with financial responsibility.

While government income rose, thanks to stronger receipts from income tax, VAT, corporation tax, and National Insurance, spending outpaced earnings once again. Higher payouts on benefits, as well as increased departmental costs driven by inflation and public sector pay rises, contributed to the gap. The UK’s debt-to-GDP ratio now hovers around 96.4%, it’s highest in decades, bringing renewed concerns over how much the government spends just to service its debts.

At the same time, ordinary Britons appear to be feeling the strain. Retail sales fell by 2.7% in May, the biggest monthly drop since the end of 2023. Year-on-year, sales were also down by 1.3%, reflecting a growing caution among consumers. The decline was widespread, hitting categories like food, clothing, alcohol, tobacco, and home goods. With household budgets squeezed by inflation, energy costs, and stagnant wages, many people are tightening their belts.

Although sales over the past three months still show modest growth overall, the sharp dip in May suggests growing economic unease. For retailers, it’s another tough signal that recovery remains fragile. For the government, it adds pressure to deliver support without worsening the fiscal outlook.

Chancellor Rachel Reeves now faces a difficult balancing act. On one side, public services and infrastructure need long-term investment. On the other hand, rising interest payments and international scrutiny demand a firm grip on borrowing. Any misstep could spook markets or dampen growth further.

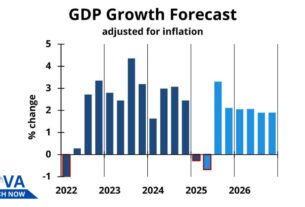

These twin challenges, high borrowing and falling consumer confidence, highlight the complex economic moment Britain faces. Austerity is politically unpalatable, yet spending freely is financially risky. As the new government prepares its first budget and long-term economic plan, decisions made now will shape how the UK navigates recovery in the months and years ahead.