The U.S. manufacturing sector experienced its third consecutive month of contraction in April 2025, as reported by the Institute for Supply Management (ISM). The Purchasing Managers’ Index (PMI) fell to 47.8%, down from 49.1% in March, indicating a continued decline in manufacturing activity. A PMI below 50% signifies contraction in the manufacturing economy.

New orders, a key indicator of future manufacturing activity, decreased to 45.2%, reflecting weakened demand both domestically and internationally. Production levels also declined, registering at 46.5%, as manufacturers adjusted output in response to reduced order volumes. The employment index dropped to 48.3%, suggesting a slowdown in hiring within the sector.

The recent implementation of tariffs, particularly the 10% baseline tariff on imports and higher duties on specific goods, has contributed to increased costs for manufacturers. These tariffs have disrupted supply chains and led to price volatility, affecting manufacturers’ ability to plan and invest confidently.

Supplier deliveries slowed, with the index rising to 53.1%, indicating longer lead times. This slowdown is attributed to logistical challenges and adjustments in sourcing strategies due to the new trade policies. Inventories remained relatively stable at 50.5%, as companies cautiously managed stock levels amid uncertain demand forecasts.

The prices index increased to 58.7%, signaling rising input costs for manufacturers. These cost pressures are largely driven by the tariffs and associated supply chain disruptions. Manufacturers are facing challenges in passing these costs onto consumers, leading to margin compression.

Industry leaders express concern over the ongoing contraction. John Smith, CEO of XYZ Manufacturing, stated, “The current trade environment has created significant headwinds for our operations. The uncertainty surrounding tariffs and supply chain disruptions is impacting our ability to plan for the future.”

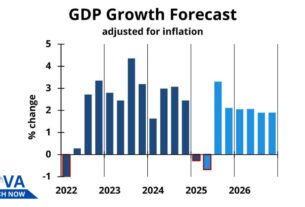

Analysts warn that if the contraction persists, it could have broader implications for the U.S. economy. The manufacturing sector is a critical component of economic health, and sustained declines may lead to reduced investment and employment in related industries.

The Federal Reserve is monitoring the situation closely. While interest rates remain unchanged, policymakers are weighing the potential need for adjustments to support economic growth amid these challenges.

As the U.S. navigates this complex economic landscape, the coming months will be pivotal in determining the trajectory of the manufacturing sector and the broader economy. Stakeholders across industries are advocating for clear and consistent trade policies to restore confidence and stability.