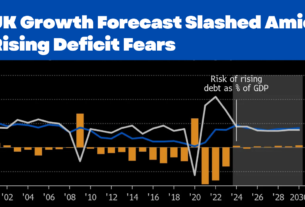

The International Monetary Fund (IMF) has upgraded its growth forecast for the UK in 2024, now expecting a 1.2% GDP increase, up from its previous 1.1% prediction. This adjustment reflects stronger-than-expected performance in recent months, signaling that the UK is on a recovery path after a difficult period. The IMF acknowledges the UK’s resilience amid global economic uncertainties, noting strong growth across sectors such as services and manufacturing.

However, the IMF has cautioned that trade tensions, particularly those linked to US tariff policies, could pose significant challenges to the UK’s economic performance in 2025. These tensions are expected to subtract 0.3 percentage points from growth next year. The broader impact of these trade conflicts, including uncertainty and potential disruptions to global supply chains, could further slow economic activity, undermining business confidence and investment.

On the domestic front, the IMF highlighted that the UK government’s policy reforms, such as changes to planning regulations and increased infrastructure investment, could provide a lifeline to future growth. If implemented successfully, these reforms could enhance productivity, reduce regulatory barriers, and boost long-term growth potential.

Additionally, the IMF recommended that the Bank of England continue its gradual approach to easing interest rates. With inflation pressures easing, further rate cuts could support economic growth without sparking runaway inflation.

In conclusion, while the UK’s economic recovery appears strong for 2024, the country faces significant risks in 2025 due to global trade uncertainties. The government’s reforms and careful monetary policies could help mitigate these challenges, but much will depend on how well these factors align in the coming years. The UK must stay agile, balancing external pressures with internal growth strategies, to navigate what lies ahead.