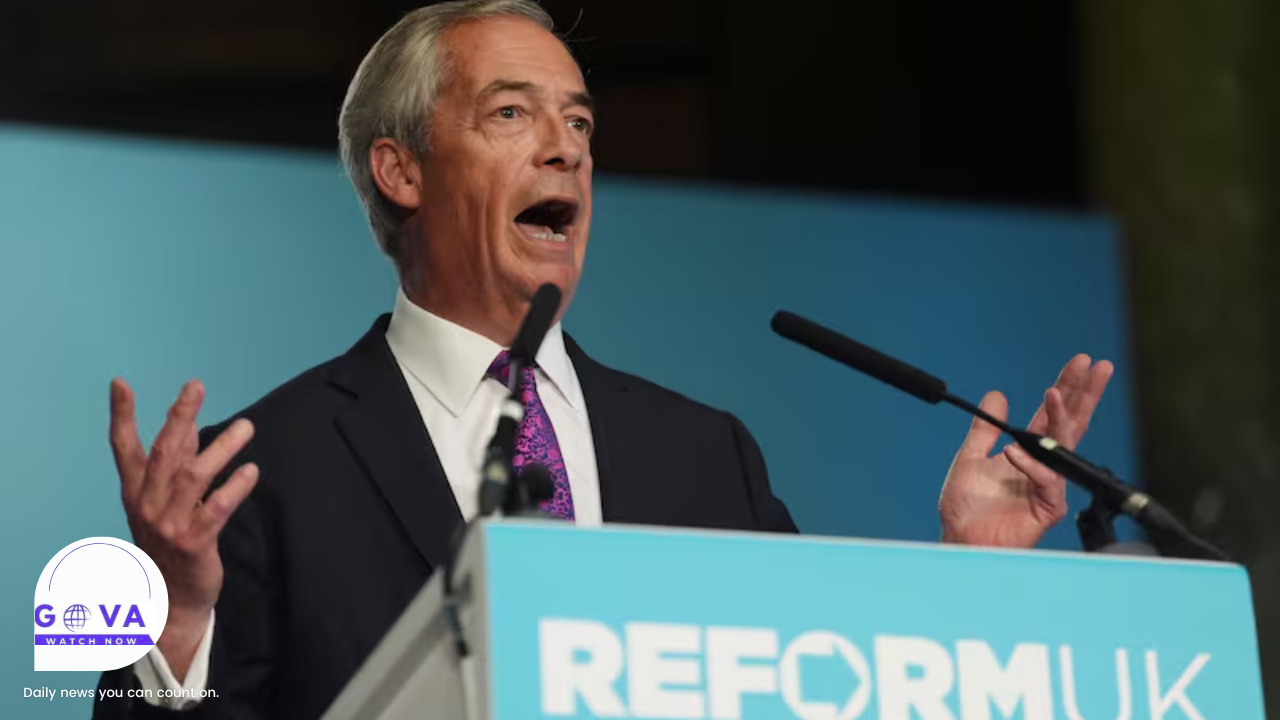

Nigel Farage, leader of Reform UK, is facing growing criticism after refusing to commit to maintaining the pensions triple lock if his party wins the next general election. The triple lock, a policy that guarantees annual pension increases in line with the highest of inflation, average earnings, or 2.5%, has become a cornerstone of pension security for millions of retirees. While Labour and the Conservatives have pledged to keep the policy, Farage’s reluctance has sparked concern among older voters and financial experts.

Alongside his ambiguous stance on pensions, Farage has announced bold, high-cost proposals such as ending the two-child benefit cap and boosting winter fuel payments. These pledges, estimated to cost £50–80 billion annually, come without detailed plans for funding. Farage claims the money can be found by scrapping net-zero initiatives and reducing asylum costs, but economists argue these savings are highly speculative and unlikely to fully offset the spending.

Critics have labeled Farage’s approach as unrealistic, with some branding the promises as “fantasy economics.” The Institute for Fiscal Studies has also weighed in, warning that while the triple lock may be financially unsustainable in the long term, abruptly removing it without a clear alternative risks undermining trust in the pension system.

As the UK edges closer to a general election, the debate over the future of the triple lock intensifies. With major parties divided on long-term pension strategy, voters are left to weigh promises against practicality, making retirement security a pivotal issue at the ballot box.