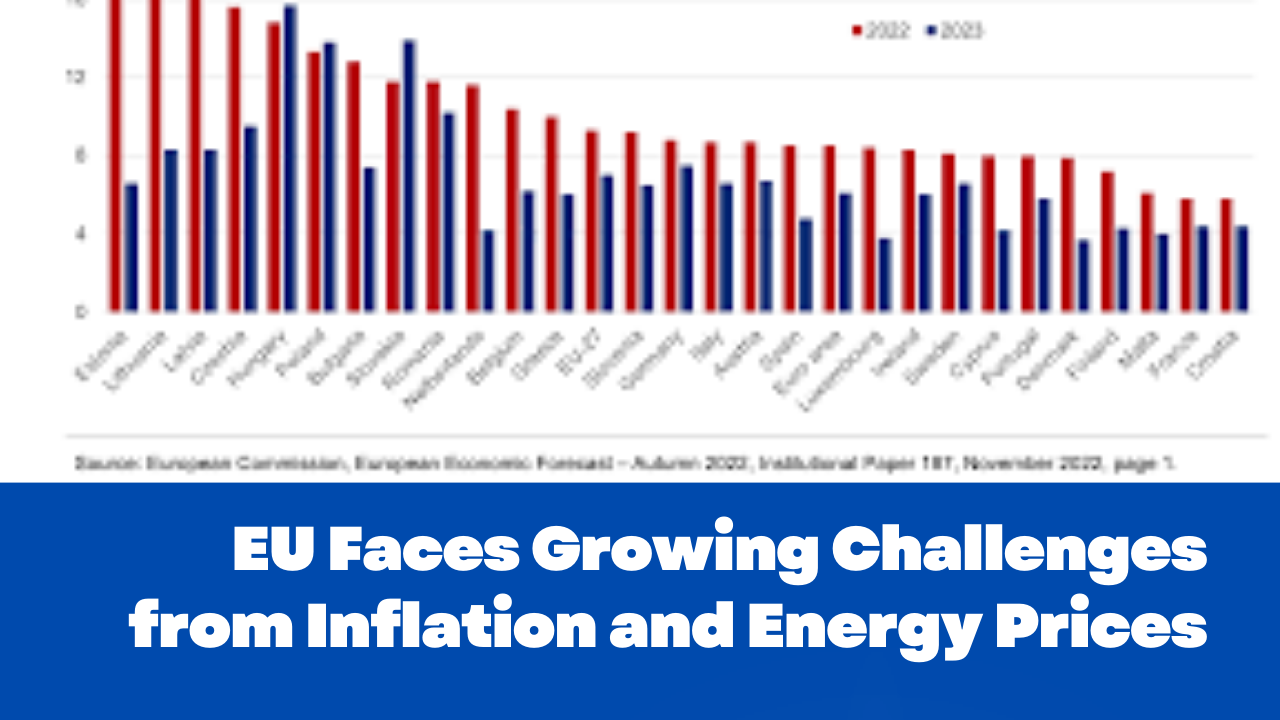

The European Union is grappling with mounting economic pressures, with inflationary pressures exacerbated by higher energy prices. The European Central Bank (ECB) has responded by raising interest rates, but inflation continues to hover around 5.1%, well above the ECB’s target of 2%. Energy prices, which spiked during the winter months due to supply chain disruptions related to the war in Ukraine, remain volatile, causing significant strain on both households and businesses.

The EU’s dependency on imported energy has been a key vulnerability exposed by the conflict in Ukraine. Although the EU has taken steps to diversify its energy sources, including increasing renewable energy investments and securing alternative gas supplies, the transition remains slow. The uncertainty surrounding energy prices, particularly natural gas, has led to rising costs for manufacturers, while households are facing higher utility bills, contributing to the cost-of-living crisis.

Additionally, the EU’s economic recovery from the pandemic has been uneven, with Southern European countries such as Italy and Spain lagging behind their Northern counterparts. While countries like Germany and the Netherlands have shown signs of resilience, the EU’s broader growth remains constrained by sluggish demand and structural issues within its member states.

The European Commission has warned that the EU’s economy will face slower growth in 2025 due to the dual pressures of inflation and energy costs. Policymakers are urging for greater fiscal coordination among member states and a comprehensive strategy to address the long-term challenges of energy security and economic convergence.