The Bank of England is facing increasing calls to pause its planned interest rate cuts as tensions in the Middle East escalate, sparking fears of rising inflation driven by global supply chain disruptions. Former Prime Minister and Chancellor Gordon Brown has publicly warned that the assumption of imminent rate reductions could be upended by the growing conflict between Israel and Iran. According to Brown, any significant disruption in the Red Sea region, a crucial artery for global trade, could create severe supply-side constraints, making it far more difficult for the central bank to meet its 2% inflation target. He emphasized that these supply issues could drive up the cost and delay the delivery of goods, compounding inflationary pressures at a time when the UK economy is already navigating a fragile recovery.

Currently, the Bank of England’s base interest rate stands at 4.25%, following a series of gradual cuts earlier in the year aimed at stimulating economic growth. However, geopolitical developments have introduced new volatility into global markets. Oil prices have begun to climb sharply amid fears of a broader regional conflict, with Brent crude recently reaching over $78 per barrel. A surge in energy costs has historically led to spikes in inflation, and there are growing concerns that the UK could face a similar scenario to the energy shocks of the 1970s. Bank of England Governor Andrew Bailey has acknowledged the seriousness of the current geopolitical risks, stating that further escalation could severely impact oil markets and complicate the central bank’s task of curbing inflation.

Prior to these recent developments, financial markets had priced in the likelihood of two 25-basis-point rate cuts before the end of the year, which would bring the benchmark rate down to around 3.7%. However, the increase in oil prices and the potential for further supply chain disruptions are prompting analysts to reconsider those projections. Many now expect the Bank to adopt a more cautious stance, possibly delaying or even scaling back the planned cuts depending on how the situation evolves.

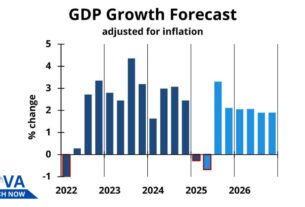

This growing uncertainty highlights the delicate balancing act faced by the Bank of England. While domestic economic conditions, including weak GDP growth and rising unemployment, suggest a need for monetary easing, the external risks posed by geopolitical instability may force policymakers to prioritise inflation control. The coming months will be pivotal in determining the Bank’s next steps and the broader direction of UK monetary policy.