China has announced a major reduction in tariffs on U.S. goods, cutting the tariff rate to 10% for a 90-day period, down from the previous 34%. This reduction, which takes effect today, is expected to have significant impacts on both global trade and U.S.-China relations.

In addition to the reduced rate, China will cancel the extra 91% duties that had been scheduled to apply in two subsequent phases. The move follows a series of trade discussions and is viewed as a significant step toward improving bilateral trade relations between the two largest economies in the world.

“This tariff adjustment is part of our efforts to foster a more balanced and sustainable trade relationship with the United States,” said a statement from China’s Ministry of Commerce. “We are committed to creating favorable conditions for the development of trade between our countries.”

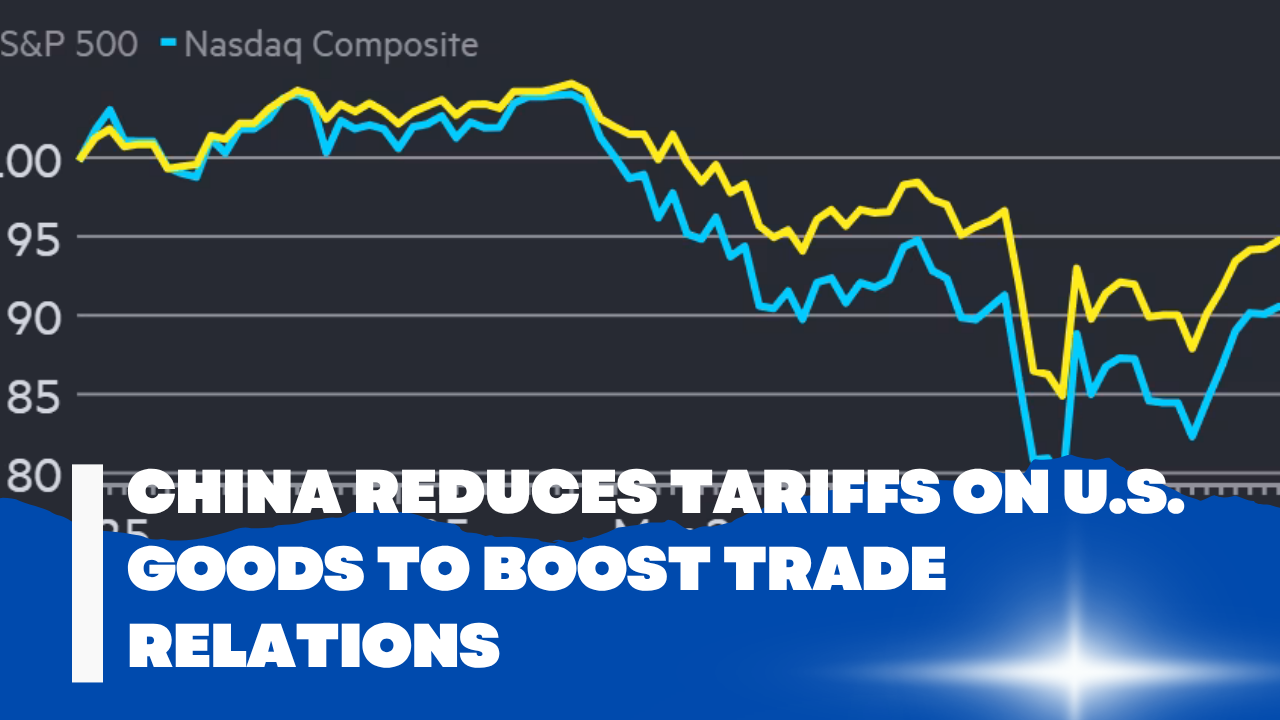

The tariff reduction is seen as a response to mounting pressure from both U.S. producers and Chinese consumers, who have expressed concerns over the higher costs of goods. The U.S.-China trade war, which began in 2018, has resulted in significant disruptions to supply chains and increased costs for companies on both sides.

“This is a win for both sides,” said Zhang Wei, an economist at Peking University. “It signals a shift toward greater cooperation, which is important for global economic stability in a time of rising geopolitical tensions.”

Key sectors expected to benefit from the tariff reduction include electronics, agricultural products, and consumer goods. The move is also seen as a positive signal to global markets, which have been waiting for more stable trade conditions after years of uncertainty.

Despite the tariff cuts, concerns remain about the long-term sustainability of the U.S.-China trade relationship, with many analysts warning that ongoing political and strategic disagreements could continue to create volatility in the market.

This latest decision is likely to have wide-ranging effects, not only on U.S. and Chinese businesses but also on global supply chains and market trends, especially in the tech and manufacturing sectors.