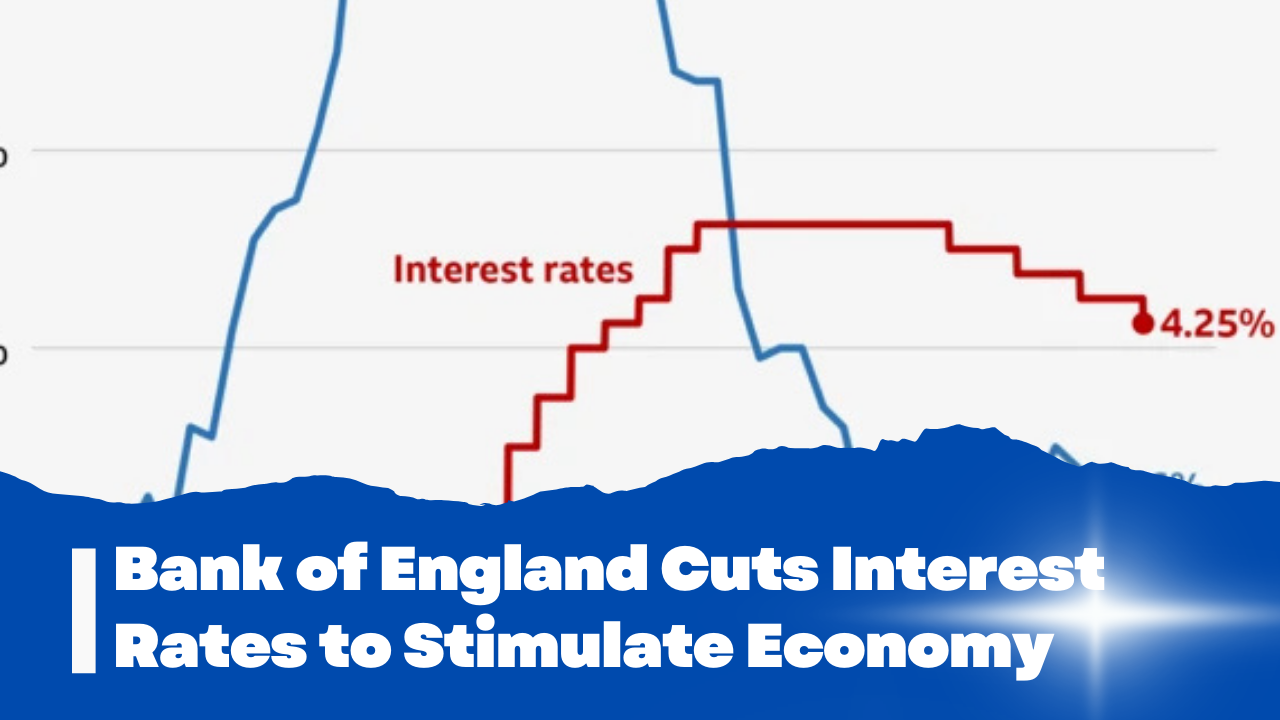

LONDON In a closely watched decision, the Bank of England has reduced its base interest rate by 0.25 percentage points, bringing it down to 4.25% the lowest level in more than two years. The decision was made on May 8 by a narrow 5–4 vote within the Monetary Policy Committee (MPC).

This policy shift is aimed at supporting economic growth as inflationary pressures ease across the UK. Governor Andrew Bailey emphasized that the disinflation process is continuing, noting that inflation fell to 2.6% in March, only slightly above the Bank’s 2% target, and lower than previously forecast.

“We are seeing encouraging signs that inflation is cooling,” said Bailey during a press briefing. “This rate adjustment reflects our commitment to securing stable growth while bringing inflation under control.”

The financial markets have reacted swiftly, with analysts now expecting at least two more rate cuts of 0.25% each before the end of the year. Economists believe these moves are part of a broader strategy to cushion the UK economy against growing international and domestic uncertainties, including sluggish GDP growth, global trade tensions, and labour market fluctuations.

While the rate cut is expected to provide relief for borrowers and stimulate investment, it may also put pressure on savers, particularly pensioners and those with fixed-income assets. Still, business leaders welcomed the move, calling it a necessary step to reignite consumer spending and support small enterprises.

This marks a significant turning point in the Bank’s monetary policy, following years of tightening in response to the post-pandemic inflation surge. The MPC’s divided vote also signals that internal debate remains intense over the pace and scale of future rate adjustments.

The next MPC meeting is scheduled for June, and all eyes will be on the Bank’s updated economic forecasts and inflation trajectory. For now, the rate cut signals a clear shift toward economic support, as the UK navigates a fragile recovery.